sales tax calculator memphis tn

Memphis collects the maximum legal local sales tax. The current total local sales tax rate in Germantown TN is 9750.

Changes To 401k What Are The Main Changes You Should Know Marca

View and print an Application for Replacement Title instructions for completion are included with the form.

. The replacement of titles and noting of liens can be processed and picked up or mailed in 3 business days. No showings until accepted contract. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax.

State Sales Tax is 7 of purchase price less total value of trade in. Please do not disturb tenant. You can print a 975 sales tax table here.

The December 2020 total local sales tax rate was also 9750. The current total local sales tax rate in Memphis TN is 9750. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

225 West Center St. There is no applicable special tax. James L Jimmy Poss 732 S Congress Blvd Rm 102 Smithville TN 37166.

M-F 8am - 5pm. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. Sales Tax Calculator in Memphis TN.

The minimum combined 2022 sales tax rate for Memphis Tennessee is. The December 2020 total local sales tax rate was also 9750. 26 cents per gallon of regular gasoline 27 cents per gallon of diesel.

2022 Tennessee state sales tax. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. This amount is never to exceed 3600.

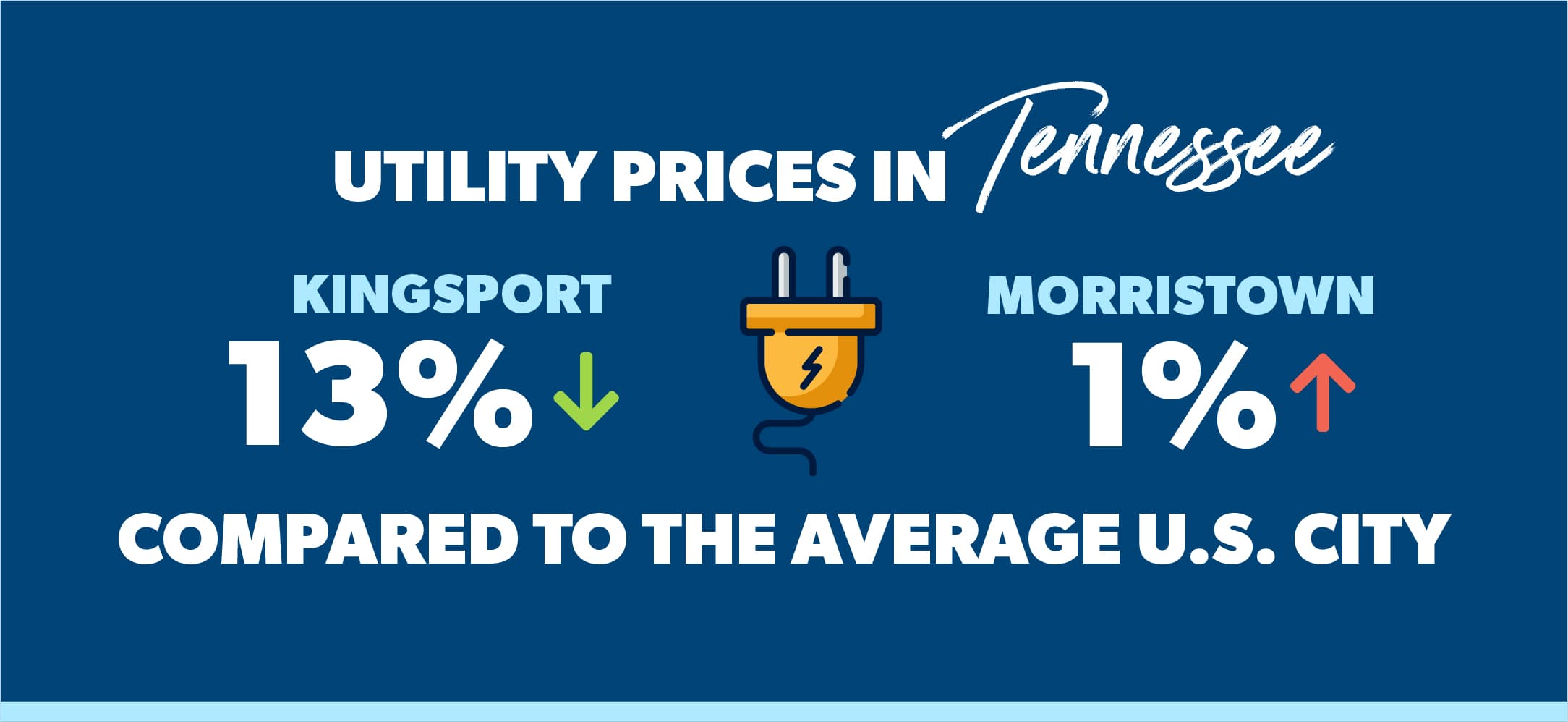

The 975 sales tax rate in memphis consists of 7 tennessee state sales tax 225 shelby county sales tax and 05 memphis tax. Kingsport TN 37660 Phone. For more information please call the Shelby County Clerks Office at 901 222.

Exact tax amount may vary for different items. Search results are sorted by a combination of factors to give you a set of choices in response to your search criteria. The fee to replace a title or note a lien is 13.

Memphis TN Sales Tax Rate. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. City tax payments can be made at any first tennessee bank location.

Sales tax calculator memphis tn. Local Sales Tax is 225 of the first 1600. Sales Tax State Local Sales Tax on Food.

The County sales tax rate is. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property and Registration Taxes and an. Real property tax on median home.

For purchases in excess of 1600 an additional state tax of 275 is added up to a maximum of 44. The Memphis sales tax rate is. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Tennessee local counties cities and special taxation districts. These factors are similar to those you might use to determine which business to select from a local Yellow Pages. Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

Memphis Tennessee and Olive Branch Mississippi. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. The local tax rate varies by county andor city.

The Tennessee sales tax rate is currently. For tax rates in other cities see Tennessee sales taxes by city and county. Using a 25000 assessment as an example.

Multiply by the tax rate 345 divided by 100. 1600 x 225 local sales tax 36 1600 x 275 Single Article tax rate 44 Total tax due on the vehicle 1851 if purchased in Tennessee. Ad Lookup Sales Tax Rates For Free.

This is the total of state county and city sales tax rates. The general state tax rate is 7. 2022 Cost of Living Calculator for Taxes.

Interactive Tax Map Unlimited Use. YP - The Real Yellow Pages SM - helps you find the right local businesses to meet your specific needs. Please contact the Shelby County Assessor for any questions on property classification at 901 222-7001.

064 average effective rate. Tax day is a time for celebration in the Volunteer State as the state has no taxes on salaries and wages. Local collection fee is 1.

The sales tax is comprised of two parts a state portion and a local portion. 3 beds 1 bath 1339 Greendale Ave Memphis TN 38127 80000 MLS 10122271 TENANT OCCUPIED. However cities and counties can collect additional sales taxes with local rates ranging from 150 to 275.

Tennessee Retirement Tax Friendliness Smartasset

Tennessee Paycheck Calculator Smartasset

Memphis Tennessee S Sales Tax Rate Is 9 75

Is Food Taxable In Tennessee Taxjar

Tennessee Income Tax Calculator Smartasset

Texas Sales Tax Rates By City County 2022

Tennessee Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Tax Filing Season 2022 What To Do Before January 24 Marca

Cost Of Living In Tennessee Ramseysolutions Com

Cost Of Living In Tennessee Ramseysolutions Com

Tennessee Sales Tax Calculator Reverse Sales Dremployee

County Clerk Sales Tax Calculator Rutherford County Tn

![]()

Tennessee Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Missouri Sales Tax Rates By City County 2022

Do You Pay Taxes When You Sell A House In Memphis Fair Cash Deal

Tennessee County Clerk Registration Renewals

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government